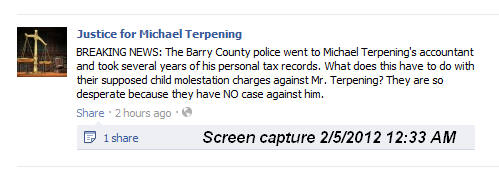

Questions about Earth Services tax returns

We'll explore publically available public information concerning Earth, Inc the corporate entity led by Michael Terpening. We'll delve into issues these documents raise...or do they raise any issues, at all?

Below are two Form 990 tax returns for Earth Services, they raise a few questions. First where are the rest of the tax returns? The company filed under two different names and two different Employer Identification Numbers (EIN). The EIN is the business equivalent of a social security number used when reporting to the Internal Revenue Service raising the question how could they report under two different EIN's when they are one single corporation, as registered with the State of Michigan. Finally, how could they operate a group home with employees and report no payment to employees? With both tax returns employee payments and benefits are zero.

The 2009 filing shows the program is filing its termination form.

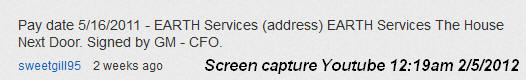

Susan Ward Gillihan, an active Terpening Follower responded

to challenges to explain possible irregularities in how people

were paid by the Terpening non-profit. Susan provides a pay

date, as well as the official name of the payor as it appears

on a check stub, "Earth Services, the House Next Door"." Susan

gives a pay date of May 16, 2011 (see below) for the exact name

used in the 2009 filing for entity that was filing its termination

tax form. Ward Gillihan

has since attributed the pay stub to,

"I typed what I read" when fellow Follower,

Jamie Moore Bell handed Ward Gillihan

a check stub.

Susan

raises the question, how is Jamie iwas paid by an entity the

IRS was told exist at the end of 2009 as late as May 2011? The

2010 tax returns are not available on

Charity Navigator, where the 2008 and 2009 tax returns are

posted.

Susan

raises the question, how is Jamie iwas paid by an entity the

IRS was told exist at the end of 2009 as late as May 2011? The

2010 tax returns are not available on

Charity Navigator, where the 2008 and 2009 tax returns are

posted.

Interestingly, enough, Susan also claims the check was signed by Gloria Mansfield, the alleged Chief Financial Officer of the Terpening, non-profit enterprise. As most check stubs would not have a signature, one has to wonder about signed stubs, but both tax forms, as filed with the IRS, list Michael Terpening as having control of the books of the organization.

The

tax forms for both 2008 and 2009 show no spending on employees

or staff. Michael Terpening is shown has having received only

$7,500.

The

tax forms for both 2008 and 2009 show no spending on employees

or staff. Michael Terpening is shown has having received only

$7,500.

Jamie Moore Bell and Susan Gillihan have, so far, refused to directly answer questions as to whether or not they were even paid as employees.

Were employer matches paid for Social Security and Medicare? Did Earth Services, after telling the IRS it was ending in 2009, pay unemployment taxes? Is Aunt Jamie getting unemployment today? Did Earth Services carry Worker's Compensation Insurance?

How were the people at Earth Services, paid when the latest available tax forms say their were no employees?

One Explanation? Maybe...

One of the biggest tax dodges, and many do it, is to pay employees as sub-contractors. It's lots less cost for the employer and often the worker like's it, too. Paying someone as a sub-contractor saves employers the costs of workers compensation insurance, the employer match for social security and Medicare, federal unemployment taxes, and state unemployment taxes; not to mention all the costs of figuring out what to take out of their employee's checks and sending that to the state and IRS every month.

But there is a catch. To be a sub-contractor, workers have to meet certain requirements, for instance

- A sub-contractor must hold herself out to the public for the work she is doing for a company.

- A sub-contractor must work independently and cannot be managed by the company paying her. She is a separate business if she is a real sub-contractor.

- A sub-contractor cannot use the company's equipment and must provide her own tools. In other words, Aunt Jamie Moore Bell driving the Earth Services van is out

If you are working for a window cleaning company and the boss tells you to climb his ladder and clean that window, you are legally an employee and not a sub-contractor. There is no way, given the structure of Earth Services, the people working for Michael Terpening could have been sub-contractors.

So what if he paid them as sub-contractors? Is Michael Terpening criminally liable?

Don't have Workers Compensation for your people? That is a state crime.

Don't take out and remit payroll taxes? That is a federal crime.

Don't pay your unemployment taxes? That could be picked up by either the state of the US Attorney for prosecution.

Didn't pay the employer match for social security or Medicare? Federal crime, folks.

And if a company pretends people were sub-contractors that is no loop hole. They were always what they were as defined by law.

In the case of Earth Services, they showed insurance expenses in 2009 of just $2,594.00 As this writer can tell you owning a business, that ain't going to cover workers compensation.

Something is amiss...

- Form 990 Earth, Inc 2008 Filing

- Form 990 Earth Services- The House Next Door Youth Program 2009 Filing

- Link for state corporate document filings

Related Story- The 2012 Tax Returns